Compound interest is a concept many have heard about but few understand the power of. The longer someone has money invested, the longer compounding can occur with exponential results. This post will overview the power of compound interest starting early.

Let’s assume you know a recent college grad that just received a diploma and their first post graduate job offer. One asset they have that is more valuable than you is time.

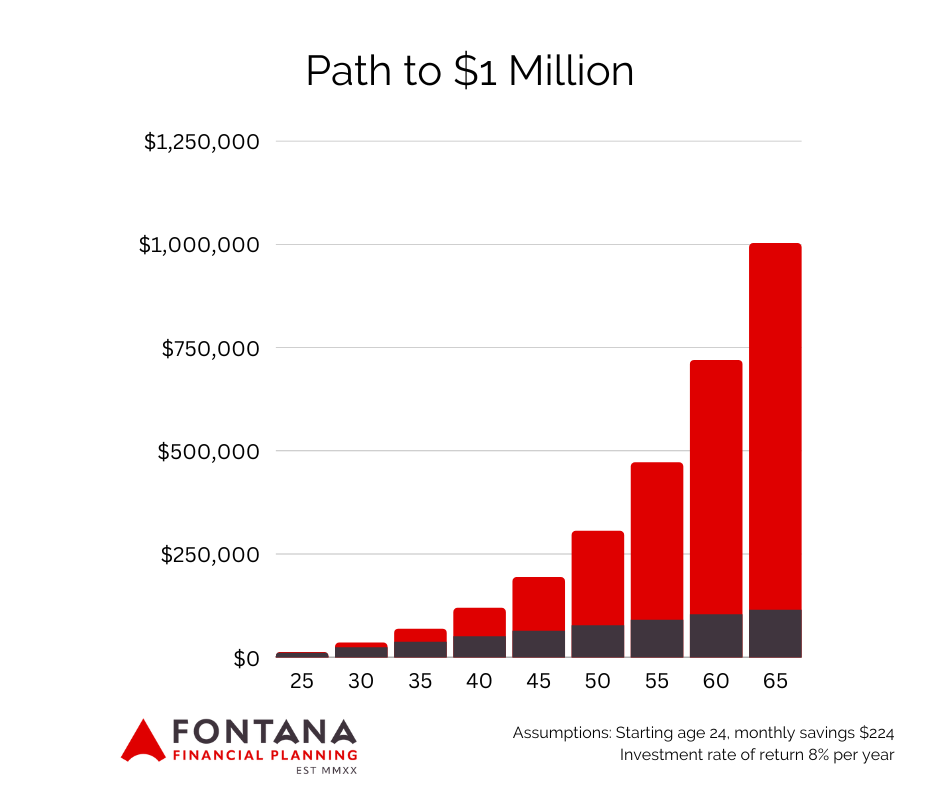

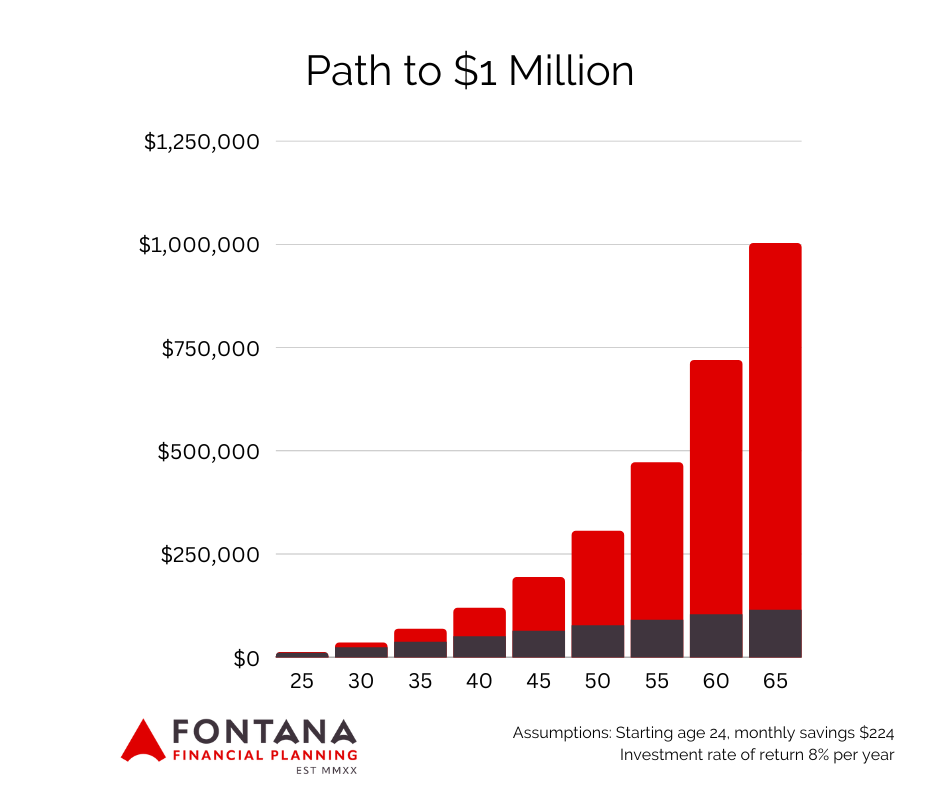

If this recent college grad wanted to have $1 million by the time they turn 65, starting right away will make the goal much more attainable. For the sake of the example, let’s assume they have a starting salary of $50,000 and a 5% employer match and they are able to earn 8% per year on their investments. We will also assume that they never increase their savings amount despite the likelihood of future raises allowing them to do so throughout their career.

How much do they need to save each month?

$224

If they simply tackle the low hanging fruit of contributing enough to get their full employer match, they will accumulate approximately $1.79 million by 65.

Now what if this individual decided they would start later? They worked hard in college and want to go enjoy themselves for the next few years. They wait until 30 to start saving.

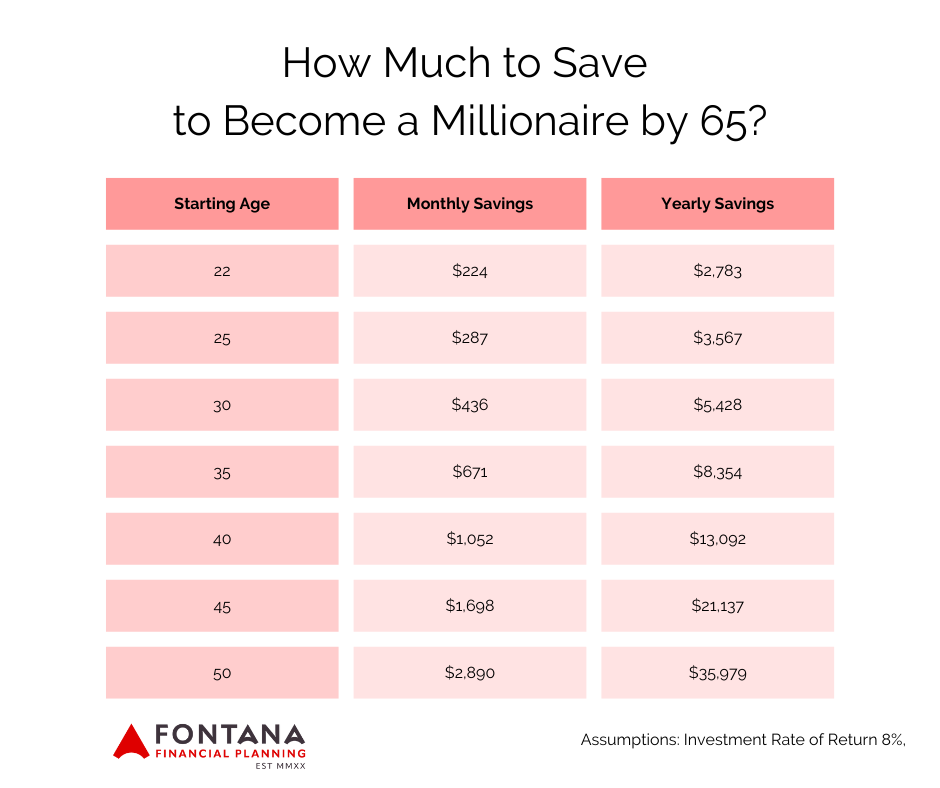

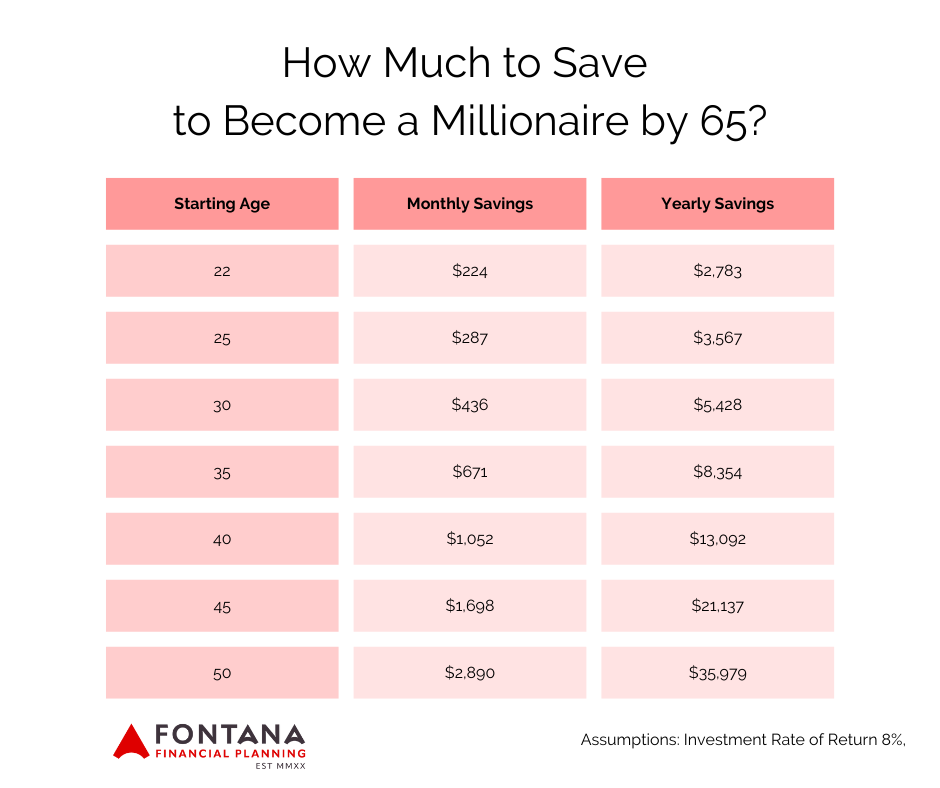

That monthly number is now $436! Nearly double what they would have needed to save at 22.

This is compounding working in reverse. They’ve lost 8 years of potential compounding and if they saved the same $224 per month that their 22-year-old self needed to save they would reach 65 with a nest egg of $513,830.

The chart below illustrates how the monthly and annual savings requirement increases over time:

If they simply tackle the low hanging fruit of contributing enough to get their full employer match, they will accumulate approximately $1.79 million by 65.

Now what if this individual decided they would start later? They worked hard in college and want to go enjoy themselves for the next few years. They wait until 30 to start saving.

That monthly number is now $436! Nearly double what they would have needed to save at 22.

This is compounding working in reverse. They’ve lost 8 years of potential compounding and if they saved the same $224 per month that their 22-year-old self needed to save they would reach 65 with a nest egg of $513,830.

The chart below illustrates how the monthly and annual savings requirement increases over time:

If you know someone entering the workforce after graduating, share this with them. Encourage them to start early and their future self will be thankful. If they can’t get all the way there now, tell them to do what they can and work towards increasing their savings down the road.

View our Finance 101 video series for more content helpful for those early in their investment journey.

Disclosure: Any opinions are those of Michael Dunham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Examples given are for illustrative purposes only. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

If you know someone entering the workforce after graduating, share this with them. Encourage them to start early and their future self will be thankful. If they can’t get all the way there now, tell them to do what they can and work towards increasing their savings down the road.

View our Finance 101 video series for more content helpful for those early in their investment journey.

Disclosure: Any opinions are those of Michael Dunham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Examples given are for illustrative purposes only. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

If they simply tackle the low hanging fruit of contributing enough to get their full employer match, they will accumulate approximately $1.79 million by 65.

Now what if this individual decided they would start later? They worked hard in college and want to go enjoy themselves for the next few years. They wait until 30 to start saving.

That monthly number is now $436! Nearly double what they would have needed to save at 22.

This is compounding working in reverse. They’ve lost 8 years of potential compounding and if they saved the same $224 per month that their 22-year-old self needed to save they would reach 65 with a nest egg of $513,830.

The chart below illustrates how the monthly and annual savings requirement increases over time:

If they simply tackle the low hanging fruit of contributing enough to get their full employer match, they will accumulate approximately $1.79 million by 65.

Now what if this individual decided they would start later? They worked hard in college and want to go enjoy themselves for the next few years. They wait until 30 to start saving.

That monthly number is now $436! Nearly double what they would have needed to save at 22.

This is compounding working in reverse. They’ve lost 8 years of potential compounding and if they saved the same $224 per month that their 22-year-old self needed to save they would reach 65 with a nest egg of $513,830.

The chart below illustrates how the monthly and annual savings requirement increases over time:

If you know someone entering the workforce after graduating, share this with them. Encourage them to start early and their future self will be thankful. If they can’t get all the way there now, tell them to do what they can and work towards increasing their savings down the road.

View our Finance 101 video series for more content helpful for those early in their investment journey.

Disclosure: Any opinions are those of Michael Dunham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Examples given are for illustrative purposes only. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

If you know someone entering the workforce after graduating, share this with them. Encourage them to start early and their future self will be thankful. If they can’t get all the way there now, tell them to do what they can and work towards increasing their savings down the road.

View our Finance 101 video series for more content helpful for those early in their investment journey.

Disclosure: Any opinions are those of Michael Dunham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Examples given are for illustrative purposes only. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.