It is not uncommon for families to engage with a financial planner after some sort of liquidity event resulting in a lump sum of money. This could be the sale of a business, an inheritance, an insurance payout, or the sale of a home among other things. The most common questions people will have is how to deploy the funds. This post will overview the two most common investment strategies for lump sums.

Does that mean the all at once option will always lead to the best outcome? No – but it is impossible to know without the benefit of hindsight. Because we don’t know what will happen we want to think probabilistically. We want to make the decision that gives us the highest likelihood of success.

Does that mean the all at once option will always lead to the best outcome? No – but it is impossible to know without the benefit of hindsight. Because we don’t know what will happen we want to think probabilistically. We want to make the decision that gives us the highest likelihood of success.

All At Once

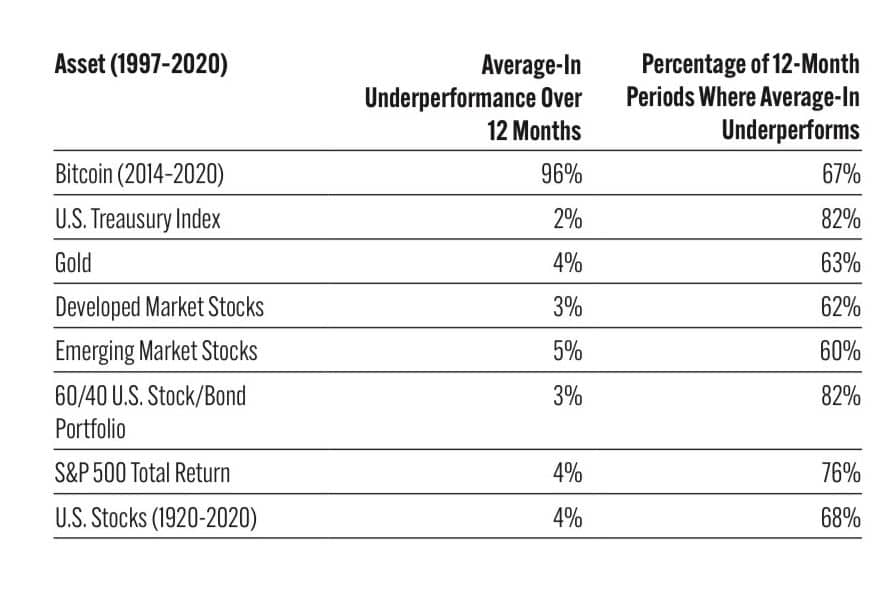

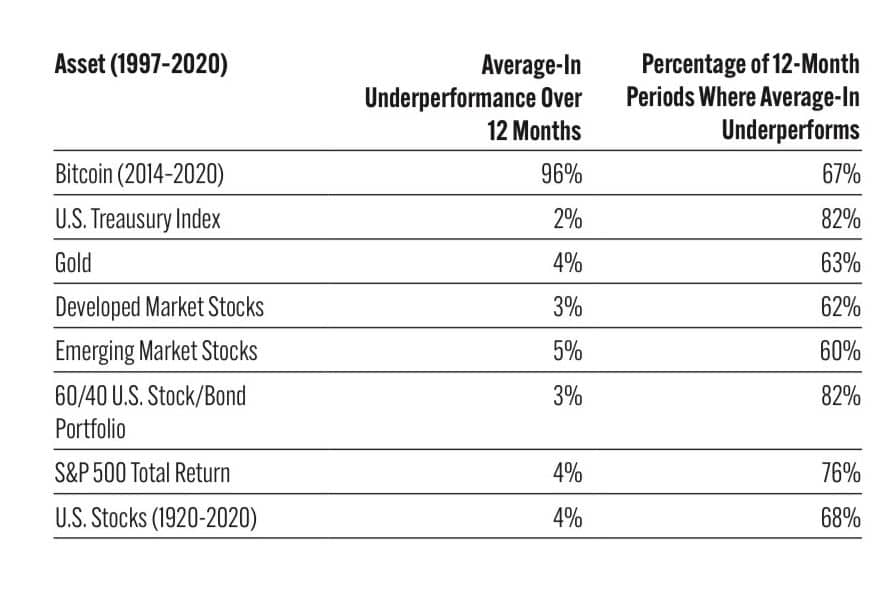

Mathematically speaking, you are more likely to come out ahead by investing the entire lump sum all at once. Intuitively, this makes sense. The market goes up over the long term and the longer funds are invested the more likely they are to go up. Research done by financial author Nick Maggiuli, in his book ‘Just Keep Buying’, looked at the probability of an all at once approach being the optimal approach compared to an average-in approach. According to his research, the all at once option was the better option 82% of the time for a 60/40 U.S. Stock and bond portfolio. When looking at just the S&P 500, the all at once approach did better 76% of the time. Does that mean the all at once option will always lead to the best outcome? No – but it is impossible to know without the benefit of hindsight. Because we don’t know what will happen we want to think probabilistically. We want to make the decision that gives us the highest likelihood of success.

Does that mean the all at once option will always lead to the best outcome? No – but it is impossible to know without the benefit of hindsight. Because we don’t know what will happen we want to think probabilistically. We want to make the decision that gives us the highest likelihood of success.