Understanding Social Security Benefits

The decision of when to claim your Social Security benefit can have implications that will both impact the rest of your life and potentially lead to drastic changes in the lifetime benefit you receive. Generally, someone is eligible to claim their Social Security benefit as early as age 62, will reach their “Full Retirement Age” between age 66 and 67, and they will hit their maximum benefit at age 70.

How is Your Benefit Determined?

To be eligible to receive Social Security you must have 40 quarters of taxable earnings. The Social Security Administration (SSA) determines a quarter of earnings not based on months worked but on dollars earned during a year. In 2023, a quarter of coverage is provided for $1,640 of earnings meaning a full 4 quarters of earnings would be achieved if $6,560 of covered earnings occurred.

Once eligible, the SSA will look at your average indexed monthly earnings (AIME) by looking at your 35 highest years of earnings. Past earnings are indexed for inflation and the average is used to determine your Primary Insurance Amount (PIA) at full retirement age.

The PIA calculation is a progressive formula that provides a higher percentage benefit compared to earnings for lower wage workers than higher wage workers. The formula replaces 90% of earnings at the lowest range, 32% of the middle range, and 15% of the upper range.

To see your projected benefit amount, you can check your Social Security statement by creating a log-in at SSA.gov. This statement will provide you an expected benefit at age 62, full retirement age, and age 67 and provide your earning history. Additionally, there can be identity theft benefits to setting up an account with the SSA.

Benefits of Delaying

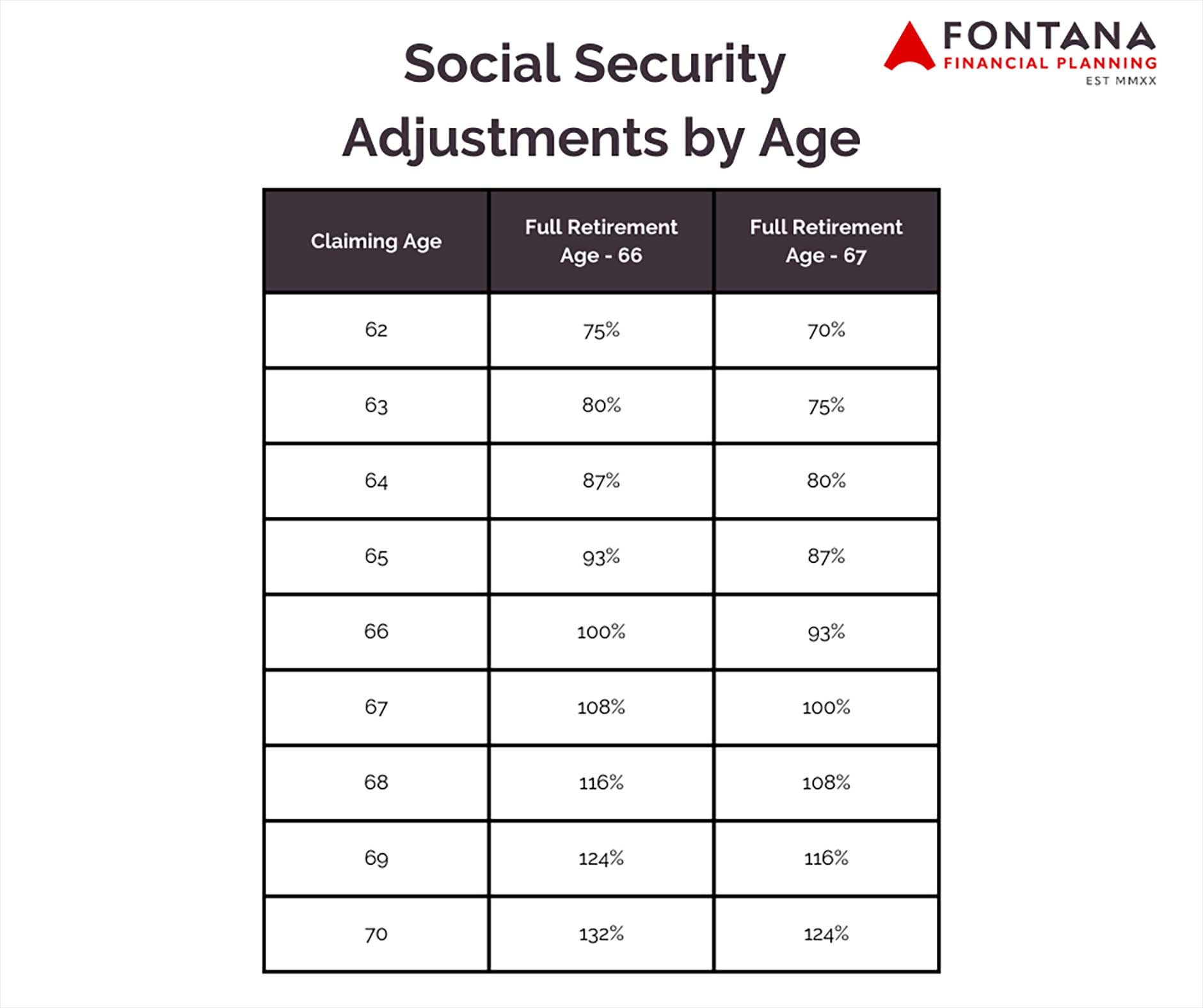

Depending on the year you were born, your full retirement age (FRA) can range from age 66 to age 67. While you can claim your benefit as early as age 62, your benefit will be reduced by 0.56% for each month for the 36 months before FRA and 0.42% for any months before that. Someone with an FRA of 67 would only receive 70% of the PIA if they claimed their benefit as early as possible.

Delaying past FRA, on the other hand, provides a benefit increase of 0.67% per month (8% annually) until age 70. Someone with an FRA of 67 that chooses to delay claiming until age 70 would receive 124% of their PIA for the remainder of their lifetime.

For a single individual, the decision of when to claim can be straightforward assuming they are not divorced or widowed. Generally, someone that is in good health will likely want to delay claiming if financially possible. Individuals that need the money or have a shortened life expectancy may consider claiming early.

The actuarial tables used by the Social Security Administration were made as part of the 1983 Amendments to Social Security. In the roughly 40 years since, life expectancies have risen and the likelihood that you will come out ahead by delaying your benefit has subsequently increased. The breakeven age is between 80 to 84 when comparing claiming at 70 to earlier ages.

Reduction in Benefits Before FRA

Individuals that claim their benefit early, while also still working can face a reduction in benefit until their FRA. In the years leading up to your FRA, this reduction amounts to $1 for every $2 of earnings in excess of $21,240. In the year of your FRA, this reduction is adjusted to $1 for every $3 of earnings above %56,520.

This reduction means that individuals who claim their benefit while working can receive a significantly reduced benefit if their earnings are above the limit. These dollars are not lost entirely, the benefit will be adjusted at the individuals FRA to account for any dollars reduced.

Planning for Couples

Married couples can select their own benefit or, if advantageous, they can select a spousal benefit. A spousal benefit is equal to 50% of the higher earning spouse’s PIA at full retirement age. Additionally, for the lower earning spouse to claim the spousal benefit the worker must claim their own benefit.

As with standard Social Security benefit, the spousal benefit will be reduced if claimed before FRA. At age 62, as spouse would receive a benefit equivalent to 35% of the higher earners PIA. That said, there are no additional credits for delaying past FRA so if you are claiming a spousal benefit, it is prudent to do so at this time.

Survivor Benefit

Upon the death of a spouse, the surviving spouse will have the ability to continue receiving the higher of the two benefits. That said, the lower benefit will go away, and this will have an impact on monthly cash flow.

If it is not possible to delay claiming both benefits until age 70, or 67 for a spousal benefit, then it may be prudent to claim the lower earners benefit first and allow the higher earners benefit to continue growing. This strategy is especially prudent if one spouse has a health condition that would indicate a shorter life expectancy as delaying the benefit would allow the surviving spouse to receive a higher payout for the remainder of their lifetime.

If the higher earning spouse has not claimed the benefit at the time of their passing, the surviving spouse will still have the ability to claim the survivor benefit. In this case, the Social Security Administration would look consider the benefit that the decedent would have received if they claimed their benefit on the day of their passing.

Taxation of Social Security Benefits

Social Security benefits are taxable as income exceeds certain thresholds. The income number that is used to determine taxation is your adjusted gross income (AGI) plus any nontaxable interest plus half of your social security benefit. This determines your combined income, which can be taxed up to 85% of the total benefit.

This is an important consideration if you are considering completing Roth conversions, which can increase your combined income, or giving via Qualified Charitable Distributions, which can decrease your combined income, as part of your annual tax planning process. If you have an expected change in the amount of income you will receive, you can adjust your Social Security withholding by completing the W-4V form on the SSA website.

There can be many nuances to an optimal Social Security strategy that depend on your specific set of circumstances. Additional planning factors may come into play if you are divorced or a younger widow. Claiming an earlier benefit can also impact the retirement planning window and should be considered alongside a Roth conversion strategy.

If you’d like to discuss your situation and review an optimal claiming strategy based on your circumstance, schedule an introductory meeting here.

If you’d like to sign-up for our monthly newsletter with four high-quality, financial planning focused posts per month, click here.