The unfortunate reality for most married couples is that one will outlive the other. When this happens many things can change while some will stay the same. This post will look to help you understand the tax impact of outliving your spouse.

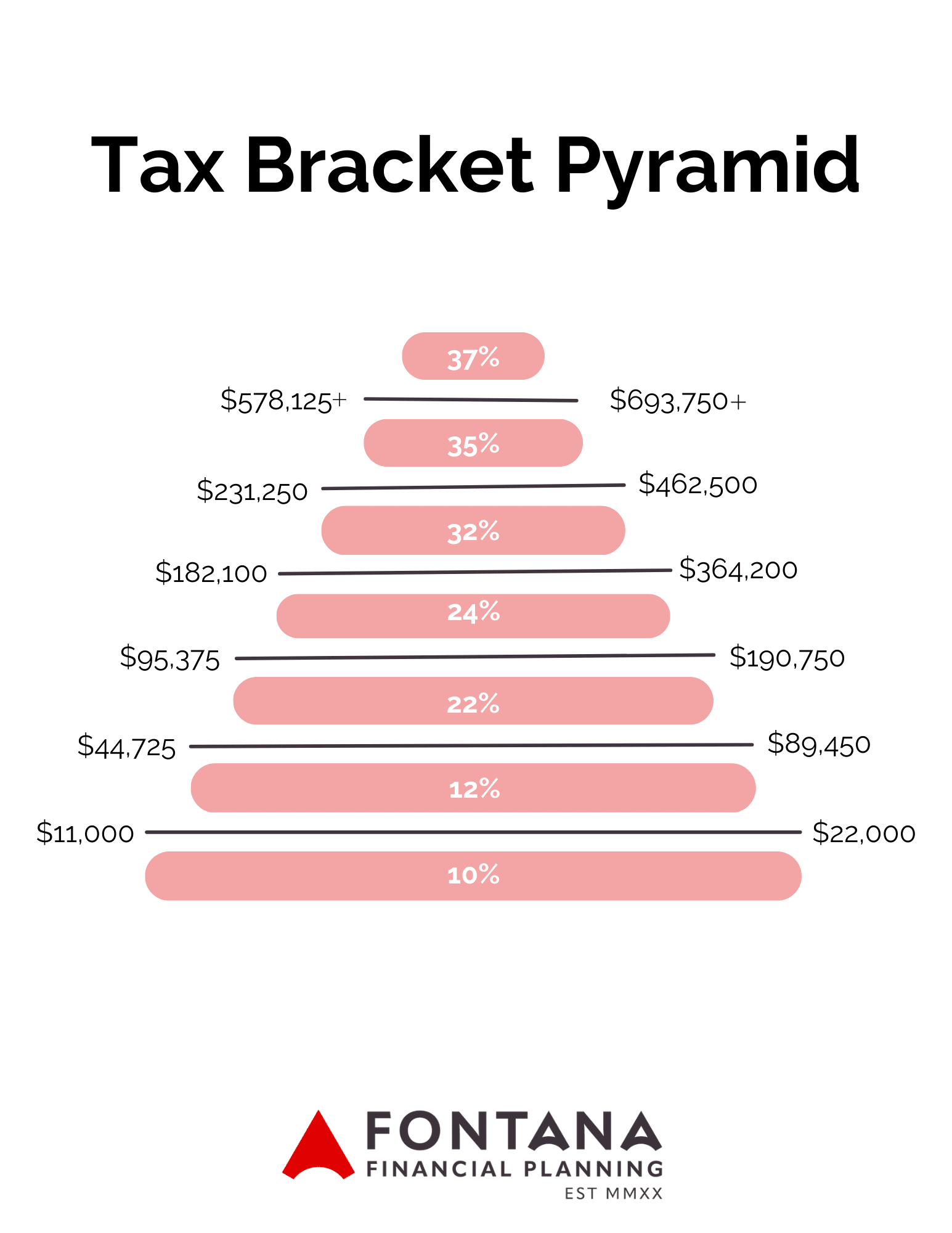

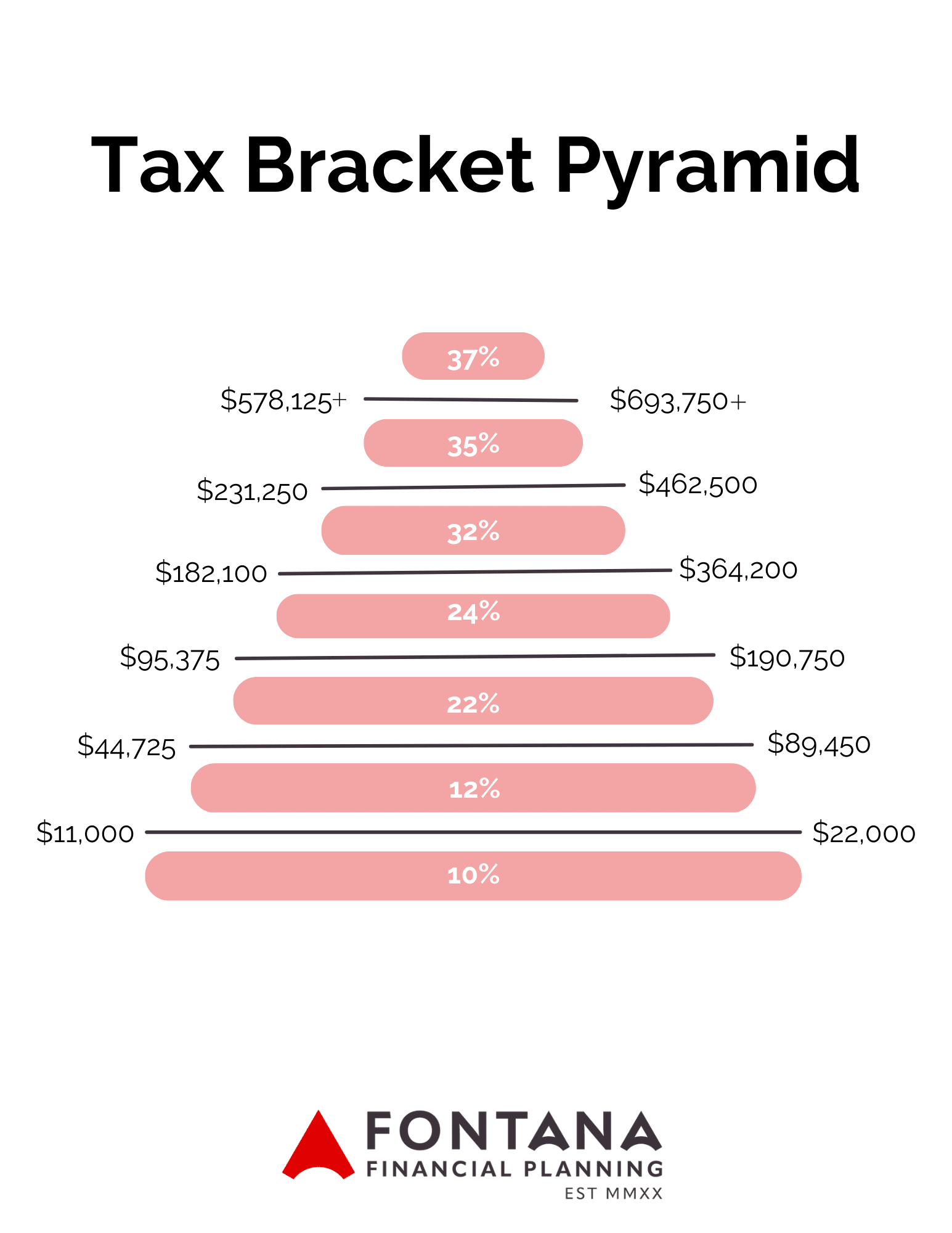

The tax code provides more favorable tax treatment to married couples. For example, a married couple filing jointly with $250,000 of income will find themselves in the 24% marginal tax bracket for 2023. That same income for a single filer will put them in the 35% marginal tax bracket – an 11% jump! Below you can view the tax bracket pyramid for 2023 to see the difference in married (right) and single (left) tax bracket thresholds.

When a spouse passes away, there are some costs and income sources that will change but there are also a number that stays the same.

When a spouse passes away, there are some costs and income sources that will change but there are also a number that stays the same.

When a spouse passes away, there are some costs and income sources that will change but there are also a number that stays the same.

When a spouse passes away, there are some costs and income sources that will change but there are also a number that stays the same.