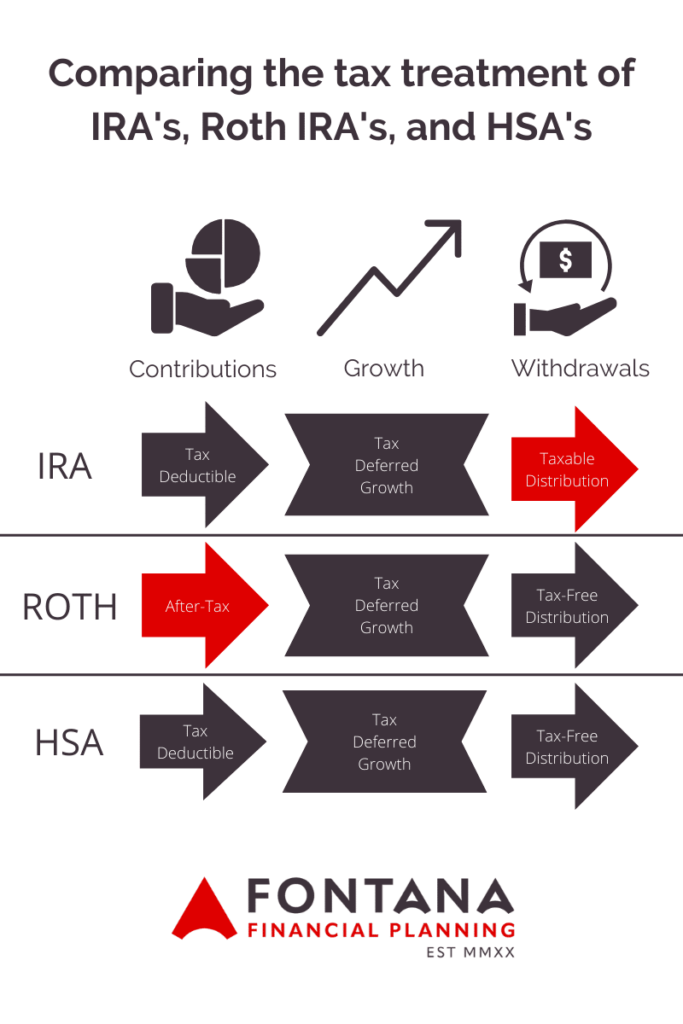

Health Savings Accounts, or HSA’s for short, offer a rare opportunity to receive triple tax-exemption on your investments. The account is available to anyone that is enrolled in a high-deductible health plan (HDHP) and receives the following tax benefits:

- Contributions are tax deductible in the year they are made

- Investments grow tax-deferred

- Withdrawals are tax free if used for qualifying medical expenses

These accounts are often offered by an employer as part of your benefits package and may include an employer contribution or match. Alternatively, anyone that is enrolled in a qualifying health plan can establish an HSA one their own. For tax year 2023, the contribution limits for an HSA are:

- $3,850 for an Individual

- $7,750 for a family

- $1,000 additional catch-up contribution for anyone age 55 or older

Once the account has been funded, you will have the option to invest the funds in anticipation of future medical needs. Some providers may require a minimum amount be held in cash but any available funds can be invested in either mutual funds, stocks or ETF’s.

Research from the Employee Benefit Research Institute shows that only 9% of HSA owners take advantage of investing their HSA funds. By not investing, you miss out on the power of tax-deferred growth – one of the three main tax benefits an HSA offers.

Individuals that have the financial means to cover medical costs out of pocket can invest these funds with no concern of needing to raise cash for unanticipated medical expenses. These funds can grow tax-deferred to create a large bucket of funds specifically for medical expenses in retirement.

Example: Don and Jan, age 45, have decided to maximize their HSA contribution each year until retirement with the hopes of creating a large reserve to cover their medical expenses in retirement. As they are both on a HDHP, they can contribute $7,750 this year and each year they are eligible and deduct that from their income. Once they reach 55 they can add an additional $1,000 catch-up contribution. By the time they retire at age 65, they accumulate $450,000 in their HSA account and any of those funds used for qualifying medical expenses will be withdrawn tax free.

Planning Tip: There is not a required timeframe in which you must reimburse yourself for a qualifying medical expense. This means that you can save medial bill receipts and wait to withdraw the funds until a later date, allowing your investments to continue to grow in the interim.

Most high-deductible health plans will be available at a much lower premium than an HMO or PPO plan that you might be currently enrolled in. A strategy to jumpstart your HSA savings with little to no impact in your cash flow would be to contribute the difference in cost to your HSA.

Example: Don is currently enrolled in an HMO plan that costs him $200 per paycheck but he decides to switch to a HDHP that will cost him $70 per paycheck. He’d like to jumpstart his HSA savings and elects to contribute the $130 difference each pay period (keeping his paycheck the same). He will save a total of $3,380 over the course of his 26 paychecks with no impact to his take home amount.

These plans differ from Flex Savings Accounts (FSA’s) in two meaningful ways as well. First, there is not a use it or lose it component with an HSA. With an FSA you are required to use any contributed funds in the same year or it is lost money but HSA’s allow you to carry over the balance indefinitely. Second, HSA’s are portable unlike FSA’s. If you leave your employer, you have the ability to transfer your HSA to your new employers plan or you can open your own.

If you’d like to discuss how utilizing an HSA can fit into your financial plan, schedule a call with our team by clicking the link here and finding a time that is convenient for you.

If you’d like to sign-up for our monthly newsletter with four high-quality, financial planning focused posts per month, click here.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and investors may incur a profit or a loss. Past performance does not guarantee future results.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.